owner's draw in quickbooks self employed

The business owner takes funds out of the business for. Afterward well have the option to either Print or Download it.

How To Pay Invoices Using Owner S Draw

An owners draw is an amount of money an owner takes out of a business usually by writing a check.

. Click the Reports tab. So your equity accounts could. To create an owners draw account.

In this video we demonstrate how to set up equity accounts for a sole proprietorship in Quickbooks. All you have to do is just click the icon. It appears in the register on printed checks and on reports that include this check.

Now hit on the Chart of Accounts option. This leads to a reduction in your total share in the business. Click Equity Continue.

Visit the Lists option from the main menu. Then choose the option Write Checks. Click Save and Close.

Quickbooksonline taxreturn financialgymQuickBooks Tutorial - How do you take your money out of your business that you need for your own living expenses an. An owners draw can help you pay yourself without committing to a traditional 40-hours-a-week paycheck or yearly salary. Self-Employed Business Taxes Simplified For Independent Contractors And Freelancers.

Go to the Help menu. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask.

A draw lowers the owners equity in the business. Here are few steps given to set up the owners draw in QuickBooks Online. To Write A Check From An Owners Draw Account the steps are as follows.

The owners draw is the distribution of funds from your equity account. Before you can record an owners draw youll first need to set one up in your Quickbooks account. Instead you make a withdrawal from your owners.

Click Save Close. Business owners might use a draw for compensation versus. Setting Up an Owners Draw Account.

The draw account is for tracking funds taken out use a different equity account for tracking funds in. Open the QuickBooks Online application and click on the Gear sign. The memo field is optional.

Setting Up an Owners Draw. Choose Lists Chart of Accounts or press CTRL A on your keyboard. We also show how to record both contributions of capita.

In QuickBooks Desktop software. Select the Expenses tab and click the Account drop-down list. Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each.

If you are self-employed sole proprietor or disregarded single-member LLC you are going to be taxed on all of your business earnings whether you take a draw or leave the. Learn about Recording an Owners Draw in Intuit QuickBooks Online with the complete ad-free training course here. Select the business account used to fund the purchase.

Go to the Business and personal expenses section. An owners draw also called a draw is when a business owner takes funds out of their business for personal use. Also you cannot deduct.

Heres a high-level look at the difference between a salary and an owners draw or simply a draw. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. Ad See How QuickBooks Saves You Time Money.

Click on the Banking menu option. Quickbooks bookkeeping cashmanagementIn this tutorial I am demonstrating how to do an owners draw in QuickBooks------Please watch. At the bottom left choose Account New.

You can also take a look at these articles for more information about Personal Withdraw. To create an owners draw log into your Quickbooks account and access Lists Chart of Accounts. Enter the total amount in the Amount column.

An owner of a sole. At the bottom left-hand side of the. To find those instructions follow these steps.

If youre a sole proprietor you must be. Start Your Free Trial Today. Fill out the other details of the cheque as youd like.

December 10 2018 0530 PM. In the Account field be sure to select Owners equity you created. An owners draw account is an equity account used by QuickBooks Online to track withdrawals of the companys assets to pay an owner.

How To Record Owner Investment In Quickbooks Updated Steps

How Much Does An Employee Cost Infographic Patriot Software Entrepreneur Business Plan Accounting Education Budget Help

Quickbooks Enterprise 5 Features For Receipt Management Quickbooks Management Enterprise

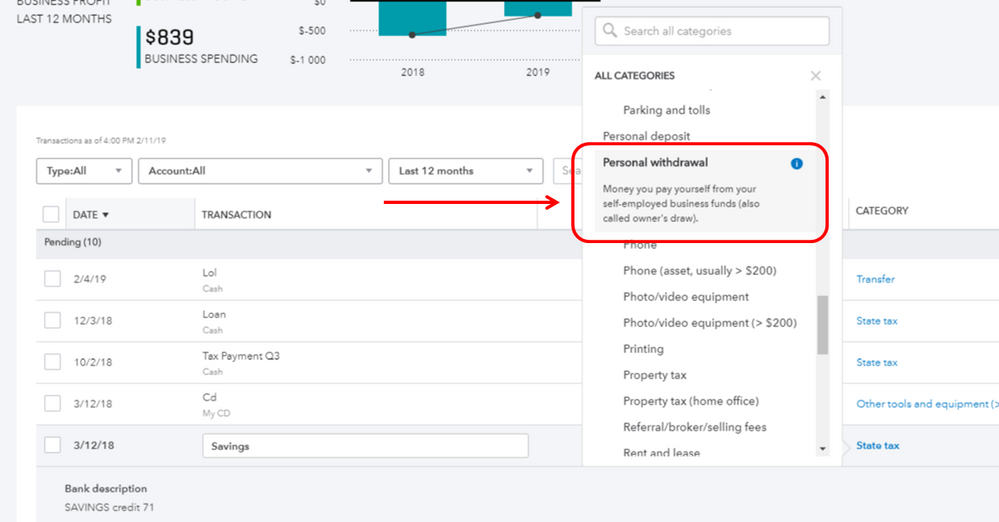

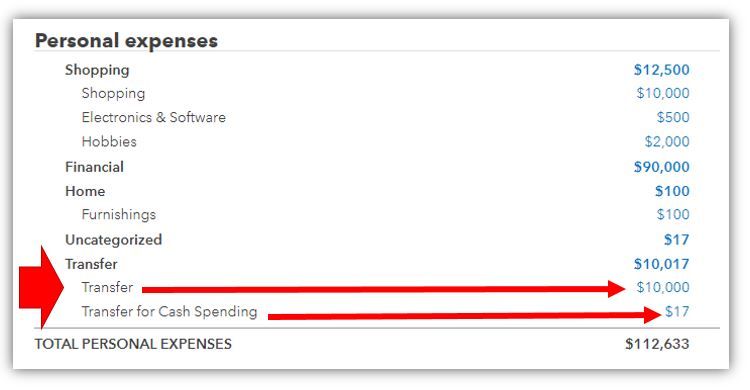

Solved Owner S Draw On Self Employed Qb

How To Pay Yourself Part 1 Taxes Bookkeeping Small Business Bookkeeping Small Business Tax Business Finance

Accept Paypal Payments Quickbooks Desktop Quickbooks Quickbooks Online Paypal

Cis Invoice Template Subcontractor Southbay Robot Invoice For Regarding Cis Invoice Template Invoice Template Invoice Template Word Professional Templates

Solved Owner S Draw On Self Employed Qb

Setup A Draw From Quickbooks Self Employed

The Landing Page Is Not Found In 2021 Accounting Software Accounting Online Accounting Software

Quickbooks Self Employed Review 2022 Carefulcents Com Business Tax Small Business Tax Small Business Bookkeeping

10 Free Spreadsheet Hacks And Templates That This Business Owner Swears By Excel Templates Business Small Business Finance Spreadsheet Business

Rose Gold Social Media Icons Sponsored Affiliate Social Gold Icons Media Business Template Social Media Icons Social Media

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Sc Small Business Accounting Small Business Bookkeeping Small Business Tax

Monthly Bookkeeping Record Template Bookkeeping Business Cleaning Business Bookkeeping

One Of The Most Common Questions I Get From Entrepreneurs Is How They Should Initially Set Up Business Tax Deductions Business Ideas Entrepreneur Business Tax

Freshbooks Review 2018 Try Cloud Accounting Software Free For 60 Days Careful Cents Freshbooks Accounting Software Small Business Accounting